Let’s face it — payday feels amazing. That direct deposit hits your account, and for a brief moment, you feel unstoppable. But then… bills, rent, impulse buys, and “just one” dinner out start eating away at your balance. Before you know it, you’re counting down the days to the next paycheck again.

The truth is, financial control isn’t about how much you earn — it’s about what you do every payday. Build the right habits, and you’ll always feel financially stable, no matter your income level.

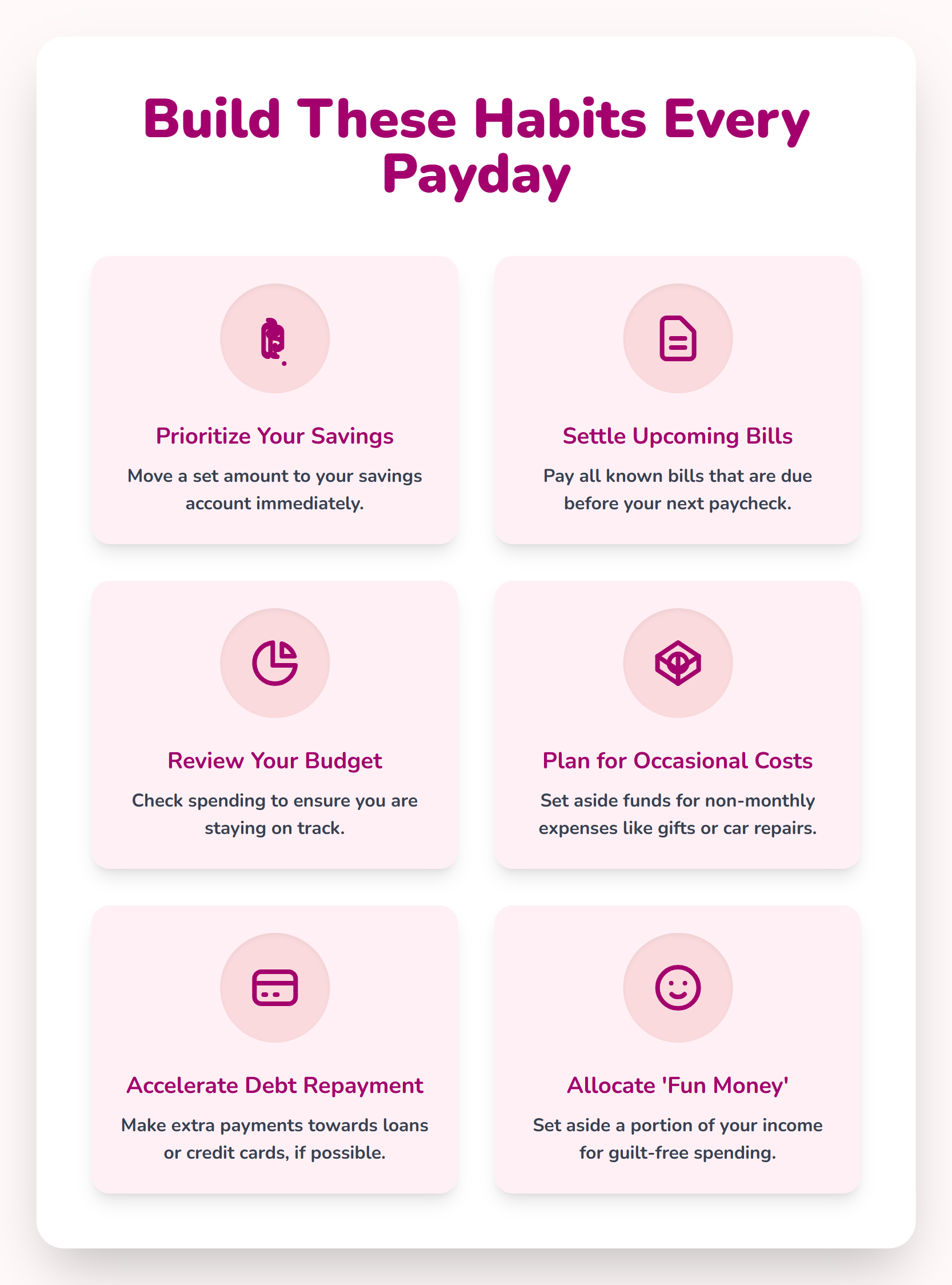

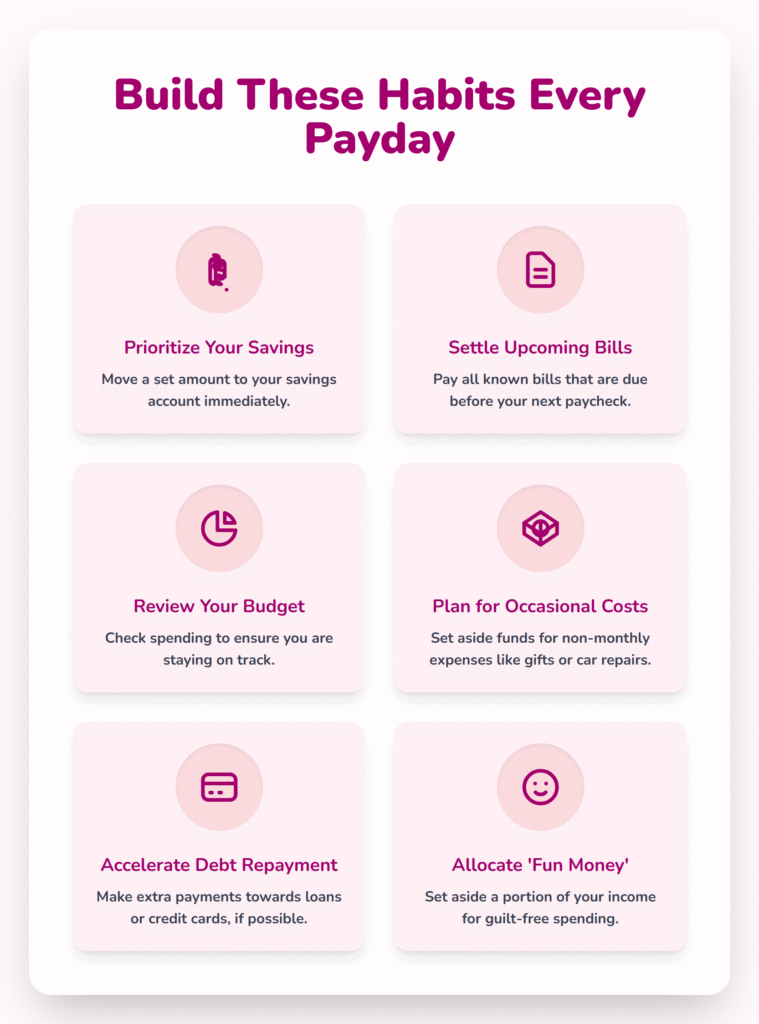

Build These Habits Every Payday

1. Prioritize Your Savings

Before you touch a single bill or buy anything, pay yourself first. That means moving a set amount directly to your savings account the moment your paycheck lands.

Pay Yourself First — The Golden Rule

Think of saving as a non-negotiable expense — just like rent or electricity. By making savings your top priority, you ensure you’re building wealth, not just surviving.

Automate Your Savings to Stay Consistent

Set up automatic transfers from your checking to savings on payday. When saving happens automatically, you remove temptation and make consistency effortless.

2. Settle Upcoming Bills

Next, take care of all the bills that are due before your next paycheck. Rent, utilities, subscriptions, phone — clear them out early.

Clear Your Obligations Before Spending

Paying bills right away gives you a clear view of what’s actually yours to spend. It prevents the “false rich” feeling right after payday.

Why Paying Bills Early Reduces Stress

No more anxiety about forgetting due dates or overdrafting. You’ll walk through the next two weeks knowing everything important is covered.

3. Review Your Budget

Once savings and bills are handled, it’s time for a quick financial check-in. Pull up your budget and see how you’re doing.

Compare Actual Spending vs. Planned Budget

Did you overspend last payday? Are your grocery or gas expenses creeping up? Adjust where needed so you stay on track.

Adjust and Realign Financial Goals

Budgets aren’t set in stone — they’re living tools. Revisit them regularly to ensure they still fit your lifestyle and goals.

4. Plan for Occasional Costs

Not every expense shows up monthly. Think gifts, car maintenance, yearly subscriptions, or home repairs. Those sneaky costs can wreck your budget if you’re not ready.

The Role of Sinking Funds in Financial Stability

Set aside small amounts for these irregular expenses every payday. Over time, you’ll have a cushion that saves you from surprise debt.

Examples of Non-Monthly Expenses to Prepare For

- Birthday and holiday gifts

- Annual insurance premiums

- Car registration or servicing

- Travel plans or special occasions

5. Accelerate Debt Repayment

If you have debt — whether it’s a credit card or student loan — make it part of your payday routine. Even small extra payments help.

The Snowball vs. Avalanche Methods

- Snowball: Pay off the smallest debts first for quick motivation.

- Avalanche: Tackle the highest interest debts first to save more long-term.

Why Even Small Extra Payments Matter

A few extra dollars toward debt each payday can cut months off repayment and save hundreds in interest. It’s momentum that builds wealth faster.

6. Allocate “Fun Money”

Here’s the part everyone loves — yes, you should spend on yourself! But do it wisely.

How Controlled Indulgence Keeps You Motivated

Giving yourself guilt-free money to enjoy makes your budget sustainable. It prevents burnout and resentment toward saving.

Avoiding Guilt While Enjoying Your Income

Designate a small, fixed percentage of your paycheck for fun — say 5–10%. Spend it however you like. You’ve earned it.

How These Payday Habits Transform Your Finances

From Living Paycheck to Paycheck to Financial Freedom

When you start saving, paying bills early, and planning ahead, you break the cycle of stress and scarcity. Suddenly, money feels predictable.

Creating Predictability and Peace of Mind

You’ll know exactly where your money goes — no surprises, no panic mid-month.

The Compounding Effect of Consistency

Each payday habit builds on the last. After a few months, you’ll notice growing savings, shrinking debt, and a stronger sense of control.

Common Payday Mistakes to Avoid

Spending Before Saving

If you wait to save what’s left, you’ll never save enough. Flip that mindset.

Ignoring Small Expenses

Those “just $5” moments add up fast. Keep an eye on them.

Forgetting Irregular Costs

Skipping sinking funds means when those big annual bills hit, your progress takes a hit too.

Pro Tips to Make Payday Management Effortless

Automate Everything You Can

Savings, bill payments, debt contributions — set them to auto. Less thinking, more doing.

Use Multiple Accounts for Clarity

Consider separate accounts for bills, spending, and savings. This visual separation helps prevent overspending.

Track with Apps or a Simple Spreadsheet

You don’t need fancy software. Even a simple note or Excel sheet can keep your money organized.

Conclusion: Every Payday Is a Chance to Build Wealth

Every payday gives you a new opportunity — to grow, to reset, and to strengthen your financial foundation.

When you follow these habits consistently, you don’t just manage your money — you master it.

The difference between struggling and thriving isn’t income — it’s discipline. Build these habits, and you’ll never fear payday again.

FAQs

1. How much should I save each payday?

Aim for at least 20% if you can. If that’s too high, start with 5–10% and increase it over time.

2. Should I pay off debt or save first?

Do both — save a small emergency fund first, then focus extra money on paying down high-interest debt.

3. How can I stay consistent with my payday routine?

Automate everything possible and set calendar reminders for the rest.

4. What’s the best way to handle unexpected expenses?

Use your sinking fund or emergency savings — never your credit card unless it’s a true emergency.

5. How do I make budgeting feel less restrictive?

Include “fun money” in your plan. When you allow yourself small pleasures, you’re more likely to stick to your goals long-term.