For the longest time, I thought financial literacy was something only “business people” or “rich investors” needed.

I believed money was just about earning a salary, paying bills, and hoping life works out.

But then reality hits.

You realize nobody teaches you how money works. Schools don’t teach it properly. Families don’t always talk about it. And most people grow up repeating the same cycle:

Earn → Spend → Struggle → Repeat

That’s when I decided to improve my financial literacy.

Not overnight. Not through complicated investing strategies. But through small habits that slowly rewired how I understood money.

And the truth is, raising your financial literacy is not hard.

It’s just about learning consistently.

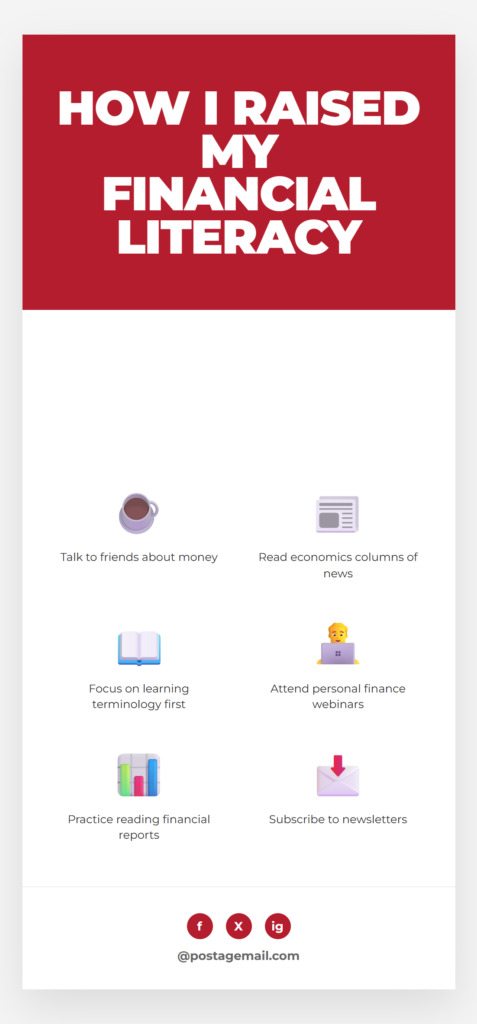

In this article, I’m going to share the 8 habits that helped me raise my financial literacy, based on the infographic you provided.

What is Financial Literacy?

Financial literacy means having the knowledge and skills to manage money confidently.

It includes understanding:

- budgeting

- saving

- investing

- debt management

- credit scores

- taxes

- inflation

- interest rates

- financial planning

In simple words:

Financial literacy is knowing what to do with money instead of guessing.

Because money is not just something you earn.

Money is something you must manage.

Why Financial Literacy is Important in Real Life

Here’s the harsh truth:

You can earn a lot and still stay broke.

Many people make good salaries but have:

- zero savings

- huge credit card debt

- no investments

- no emergency fund

And then they wonder why they feel financially stressed all the time.

Financial literacy helps you:

✅ avoid bad financial decisions

✅ build long-term wealth

✅ understand investments

✅ plan for emergencies

✅ stop living paycheck to paycheck

✅ feel confident and secure

Once you become financially literate, you stop fearing money.

You start controlling it.

How I Raised My Financial Literacy (Step-by-Step)

Let’s go through the exact habits that helped me grow financially smarter.

These steps are practical, beginner-friendly, and can be followed by anyone—even if you feel like you know nothing right now.

1. I Sent Myself a Weekly List of Topics to Learn

One of the biggest mistakes beginners make is trying to learn everything at once.

They jump from:

- crypto today

- stock market tomorrow

- real estate next week

- budgeting after that

And eventually, they get overwhelmed and quit.

So I did something simple:

Every week, I made a list of money topics I wanted to learn.

For example:

Week 1: Budgeting and saving

Week 2: Inflation and interest rates

Week 3: Credit cards and debt

Week 4: Investing basics

Week 5: Retirement accounts

Week 6: Taxes

This helped me stay organized and focused.

Why This Works

Because financial literacy is like building a house.

You can’t build the roof before the foundation.

Best Weekly Topics to Start With

- Budgeting

- Emergency funds

- Good debt vs bad debt

- Credit score

- Compound interest

- Mutual funds

- Index funds

- Stock market basics

- Real estate basics

- Insurance

Once you do this for a few months, your knowledge grows automatically.

2. I Watched Finance Videos Daily

Reading books is great, but videos are the fastest way to learn when you’re starting.

So I made a habit:

I watched finance videos daily (even 10–15 minutes).

Not random motivational content, but real educational videos explaining:

- how banks work

- how investing works

- how people build wealth

- why debt traps people

- how inflation affects money

Why Watching Videos Works

Because financial concepts can feel confusing when explained in textbooks.

But videos simplify everything with examples.

What Type of Videos Help Most

- budgeting breakdowns

- investing for beginners

- “how to get out of debt” guides

- real-life money stories

- economic news explained simply

Over time, finance content stops feeling scary.

It starts feeling normal.

3. I Started Talking to Friends About Money

This was one of the most powerful habits.

Because in most cultures, money is a “silent topic.”

People will discuss everything:

- relationships

- politics

- drama

- entertainment

But they won’t discuss money.

That’s why many people stay financially weak.

So I started doing something different:

I talked to friends about money openly.

Not in a bragging way.

But in a learning way, like:

- “How do you save monthly?”

- “Do you invest?”

- “What’s your biggest money mistake?”

- “How do you manage expenses?”

Why This Helps

Because money conversations expose you to:

- new ideas

- different lifestyles

- smart strategies

- real mistakes people made

You learn faster from people’s experiences than from theory.

Bonus Benefit

Talking about money also removes fear and shame.

You stop feeling alone.

You realize everyone is figuring it out.

4. I Read Economics Columns in the News

This habit changed the way I understood the world.

Because financial literacy is not just personal finance.

It also includes understanding the economy.

So I started reading economics news such as:

- inflation updates

- interest rate changes

- job market trends

- business reports

- global economy events

Why This Matters

Because when you understand economics, you understand why prices rise.

You understand why:

- rent increases

- food becomes expensive

- salaries feel smaller

- currencies lose value

Most people complain about inflation.

Financially literate people prepare for it.

What to Focus On

- inflation rates

- central bank interest rates

- housing market updates

- currency trends

- stock market summaries

Even reading 5 minutes daily makes you smarter than 90% of people.

5. I Focused on Learning Terminology First

This is one of the smartest things I ever did.

Because finance has its own language.

And if you don’t understand the words, you can’t understand the topic.

So instead of jumping into investing immediately, I focused on learning basic terms like:

- assets

- liabilities

- net worth

- cash flow

- equity

- dividend

- index fund

- mutual fund

- capital gains

- interest rate

- inflation

- APR

- ROI

- liquidity

Why This Works

Because once you understand terminology, finance becomes easy.

It’s like learning English.

First you learn words, then sentences, then full conversations.

Pro Tip

Make a personal finance glossary in your notes app.

Every time you hear a new term, write it down and learn it.

6. I Attended Personal Finance Webinars

At first, I thought webinars were boring.

But then I realized something:

Webinars are basically free education from experts.

Many finance educators and institutions host webinars about:

- investing

- saving

- retirement planning

- budgeting

- business finance

Why Webinars Help

Because they teach structured knowledge, not random information.

Instead of learning bits and pieces, webinars give you a complete topic explained in one session.

What You Gain from Webinars

- real-life strategies

- financial tools

- Q&A sessions

- motivation from other learners

- better understanding of money systems

Even attending one webinar per month can upgrade your mindset massively.

7. I Practiced Reading Financial Reports

This is the habit that separates normal people from serious wealth builders.

Because if you want to understand investing, you must understand financial statements.

I started practicing reading:

- company balance sheets

- profit and loss statements

- income reports

- cash flow reports

At first, it looked like a nightmare.

But slowly it became understandable.

Why This Matters

Because financial reports tell you:

- if a company is strong

- if it’s growing

- if it has too much debt

- if it is profitable

Even if you never become a stock investor, this skill makes you smarter in business and decision-making.

Where You Can Use This Skill

- investing

- running your own business

- analyzing startups

- understanding company performance

- improving your job in finance-related fields

This skill makes you financially sharp.

8. I Subscribed to Newsletters

Newsletters are underrated.

They deliver financial education directly to your inbox, without you searching for it.

So I subscribed to:

- finance newsletters

- investment updates

- business news summaries

- market insights

Why Newsletters Work

Because they teach you consistently in small bites.

Instead of spending 2 hours once a month, you learn 5 minutes daily.

And daily learning builds mastery.

What Kind of Newsletters Are Best

- beginner personal finance newsletters

- investment basics newsletters

- economic update newsletters

- business and startup newsletters

Even if you read only 1 newsletter daily, your knowledge grows rapidly.

The Secret to Financial Literacy: Consistency Over Intelligence

Here’s what I learned:

You don’t need to be a genius to become financially literate.

You just need consistent learning.

Even if you learn 20 minutes daily, in 6 months you will be ahead of most people.

Most people never take finance seriously until they are broke.

But financially smart people learn early and build wealth slowly.

Common Mistakes People Make When Learning Finance

Let’s be honest—many people fail at financial literacy because they do the wrong things.

Here are the most common mistakes:

1. Trying to learn everything at once

Finance is a huge subject. Take it step-by-step.

2. Watching “get rich quick” influencers

Most of them are selling dreams, not education.

3. Not applying what they learn

Financial literacy is useless if you don’t save, budget, or invest.

4. Being scared of investing

Investing is not gambling when you understand the basics.

5. Ignoring debt and expenses

You can’t build wealth while drowning in debt.

A Simple 30-Day Plan to Raise Your Financial Literacy

If you want to follow a clear plan, here’s a powerful one:

Week 1: Learn the Basics

- budgeting

- savings

- net worth

- debt

Week 2: Learn the Economy

- inflation

- interest rates

- how banks work

Week 3: Learn Investing Basics

- stocks

- index funds

- mutual funds

- compound interest

Week 4: Apply Knowledge

- track expenses

- set a monthly budget

- start saving

- open an investment account (optional)

This plan alone will change your money mindset forever.

Final Thoughts: Financial Literacy is a Superpower

Raising financial literacy is one of the best decisions you can ever make.

Because once you understand money, life becomes easier.

You stop living in fear.

You stop wasting income.

You stop making financial mistakes.

You start planning for your future.

And most importantly…

You stop depending on luck.

Financial freedom doesn’t come from working harder.

It comes from learning smarter.