If you want your child to grow up confident with money — not terrified of it, not obsessed with it, but skilled and calm — the best time to start is now. Yep, now. Not when they’re eighteen and opening their first bank account. Not when they’re off to college. Right now. Because money habits start early, and little lessons stack into real-life competence.

This guide is a conversational, practical roadmap: what to teach, when to teach it, and exactly how to do it — from toddlers counting coins to teenagers getting their first credit card (or not). I’ll toss in research-backed tips, real-life activities, and a tidy resources list at the end so you can keep reading or point your kid to solid, kid-friendly tools.

Let’s dive in.

Why start early? Because habits form fast

Here’s the plain truth: kids start noticing money sooner than most adults realize. At the grocery store, in the kitchen, when a grandparent slips them cash — these small moments shape big habits. Research and expert guidance suggest that children absorb money concepts early and that their money habits often crystallize in childhood. In short: waiting to “teach them later” usually means missing a golden window.

That doesn’t mean you need a degree in finance to help your kid. You need consistent, age-appropriate conversations and hands-on activities. Think of money lessons like teaching riding a bike: start small, practice often, and slowly pull back support as they gain confidence.

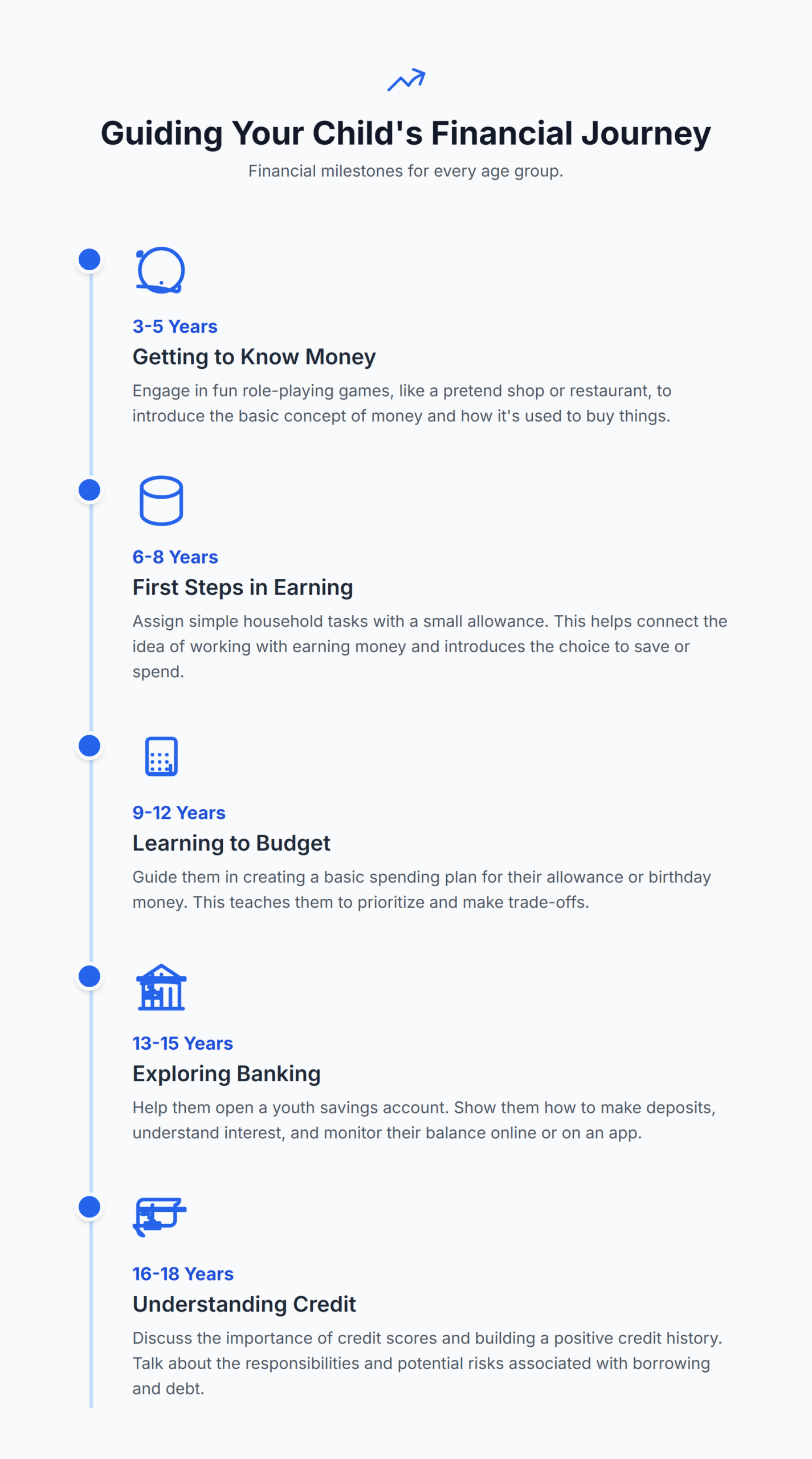

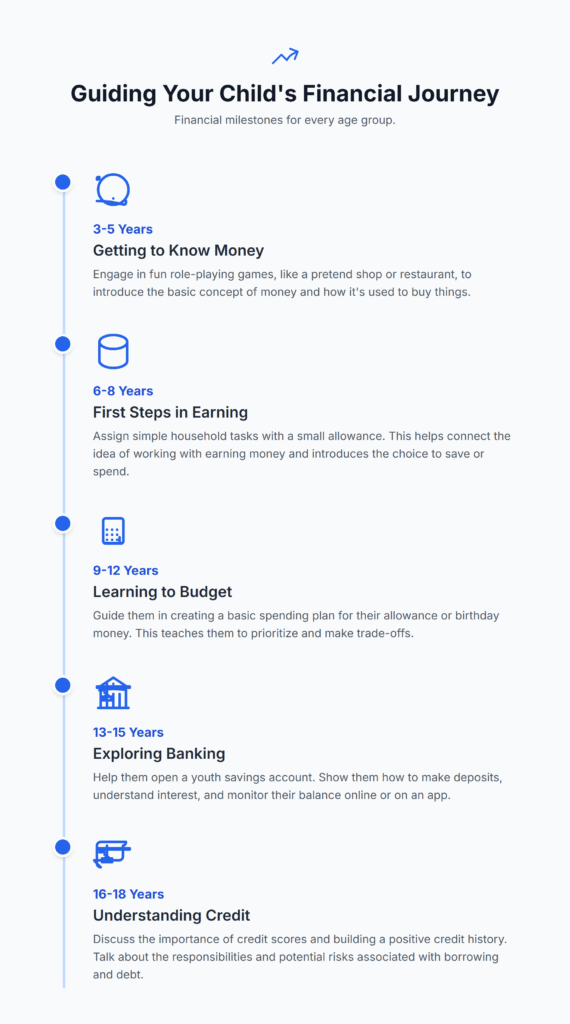

Ages 3–5: Understanding coins, bills, and the idea of “trade”

What to focus on:

- Identifying coins and bills.

- Counting small amounts.

- Understanding that money is used to get things (trade).

- Basic choices: “Do I spend this now or save for something later?”

Why this age:

Preschoolers are concrete thinkers. They love role play and simple counting. You can build a foundation with toys and games — no lectures, no pressure. Simple and playful wins.

Simple activities that actually work

- Play “store.” Use real coins and have your kid “buy” toys or snacks from you. Let them hand over the money and you hand over the item. It’s tactile, immediate, and memorable. (This classic is recommended by financial education programs for parents.)

- Coin hunts. Hide coins around the house and let them find and sort by size or value. Make a chart of what each coin “buys” (a sticker, a small snack).

- Read money-themed picture books. Many resources recommend weaving money lessons into storytime — it’s less like a lesson and more like play.

Tips for parents

- Keep explanations short. “This is a nickel. Five cents. You can save five nickels to buy a toy.”

- Avoid shame or moralizing around money. When a toy is too expensive, say, “That’s a lot of money — let’s think about saving for it,” rather than, “You can’t afford it.”

- Make the experience joyful. Money should feel like a neutral tool, not a source of stress.

Ages 6–8: Introduction to earning — allowance, chores, and values

What to focus on:

- The idea that people earn money by doing work.

- Basic saving vs spending choices.

- The value of small goals (save for a toy).

Allowance and chores — how to do it

This is where families diverge. Some tie allowance directly to chores. Others give a basic allowance as “family membership” and keep chores separate. Both approaches can work — but they emphasize slightly different lessons:

- Allowance-for-chore model teaches transactional thinking: you do X, you get paid Y. That’s close to the real adult world.

- Allowance-as-family-membership separates household responsibility (chores) from money management (allowance), which can help preserve intrinsic motivation for helping around the house. Research suggests chores are associated with later-life competence and responsibility, so keep chores regular whether or not you tie money to them. PubMed+1

Practical setup

- Keep the allowance predictable (weekly or fortnightly). Consistency is the lesson.

- Encourage splitting the allowance into jars or labeled envelopes: Spend / Save / Give. This simple visual helps younger kids see how money can be used in different ways.

- Set a small, achievable savings goal (e.g., a toy), and celebrate when they reach it. That payoff teaches delayed gratification.

Activities you can do

- Goal board. Use stickers to mark progress toward a saving goal. Kids love stickers.

- Mini-budget for a party. Give them a little “party fund” and ask them to plan snacks and decorations within that budget. Teaches prioritizing and tradeoffs.

Tip: Keep conversations about work positive. “We all chip in at home because we live together,” is healthier than “you will earn money only if you clean.”

Ages 9–12: Simple budgeting, saving, and planning

What to focus on:

- Managing larger amounts (birthday money, more allowance).

- Tracking spending and creating simple budgets.

- Understanding the idea of interest (basic) and why banks might pay you to save.

Why this stage matters

Pre-teens begin to make more autonomous choices. They can plan ahead and understand cause and effect better. This is a prime time to start formalizing money habits.

Hands-on budgeting

- Three-column budget. Have them divide funds into “Spending,” “Saving,” and “Giving.” For older kids, add “Long-term” and “Short-term.”

- Tracking app or notebook. Let them record purchases for a month and then review what they spent on. This builds real accountability.

Show — don’t just tell

- Open the bank app together. If they have a youth savings account, show deposits and how interest slowly adds up. The Consumer Financial Protection Bureau’s Money as You Grow resources have age-appropriate activities to do with kids in this stage. Consumer Financial Protection Bureau

- Introduce the idea of budgeting for choices. Present two scenarios: buy a moderately priced item today, or save for a better version later. Ask: which would you choose and why?

Games and projects

- Mock projects. Give them $20 and ask them to plan a day out with a friend. They must allocate money for transport, snacks, and one activity.

- Entrepreneur mini-projects. Lemonade stand? Pet-sitting? Use these as real-world labs for price-setting, cost calculation, and profit.

Talk about advertising

At this age, kids are bombarded by ads. Teach them that ads are designed to make things look irresistible — and that thinking before buying is okay. Encourage a “sleep on it” rule for bigger purchases.

Ages 13–15: Banking basics — accounts, online safety, and more responsibility

What to focus on:

- Opening (or being added to) a savings account.

- Digital money literacy: banking apps, online safety, passwords.

- Earning: part-time jobs, gigs, and entrepreneurship.

- The concept of interest and compound growth (simplified).

Opening a bank account

- Consider a youth savings account or a joint account where you’re a co-owner. Show them how deposits work, how to read a statement, and how to transfer money. Many banks offer teen accounts with parental oversight — these are a great sandbox. The OECD and other educational organizations recommend practical, hands-on financial experiences in early teens to build competence. OECD+1

Online safety and digital transactions

- Teach them never to share account passwords. Use two-factor authentication. Explain that cyber scams exist and some promises are too good to be true.

- Go over safe payment methods for online purchases and how to check transaction histories.

Earning more seriously

- Encourage small, real-world income: babysitting, yard work, tutoring. These jobs teach negotiation, responsibility, and taxes (basic awareness).

- If they earn, require them to allocate a portion to savings. This builds habit.

Real talk about college and loans (light touch)

Now’s the time for an honest, age-appropriate conversation about education costs. Use ballpark numbers, discuss scholarships, and explain the idea of borrowing responsibly. Don’t overload with detail — just plant seeds.

Activities and experiments

- Open a real savings tracker. Track a mid-term goal (e.g., buy a used laptop) and show how increasing monthly savings gets them there faster.

- Run a small business from start to finish. Price costs, consider taxes, track profit. This is advanced but doable — and eye-opening.

Ages 16–18: Credit, debt, taxes, and launching into financial independence

What to focus on:

- How credit works: credit reports, credit scores, interest rates.

- The dangers and mechanics of debt (student loans, credit cards).

- Filing simple tax returns (if they earn).

- Making bigger financial decisions: car purchases, student loans, first apartment.

Credit — the good, the bad, and the necessary

Credit can be useful if used responsibly, and destructive if misused. Teach them:

- A credit score is a number used by lenders to evaluate how likely someone is to repay a loan. Scores typically range from 300–850. Paying bills on time helps scores; missed payments lower them. (The FTC explains this concisely.) Consumer Advice

- Starting small is fine: a secured card, or being an authorized user on a parent’s card (with monitoring), can help them gradually build history. But heavy borrowing can lead to long-term costs.

Practical steps for parents

- Review credit reports together. Teenagers can learn how to order free annual credit reports in many countries (or learn how this works in your jurisdiction). Show them how errors can happen and how to dispute them.

- Discuss terms and fine print. Teach them how to compare interest rates, what APR means, and how minimum payments can trap borrowers into paying more interest long-term.

Taxes and early employment

If your teen starts working, they need to understand basics:

- Withholding from paychecks, tax forms, and what to keep for tax time. Show them how to file a simple return or work with a tax professional for the first year.

Preparing for independence

- Budget for rent. Run a mock budget that includes rent, utilities, groceries, transport, and savings — then show how wages map to that. Many teens are shocked to learn how quickly costs add up.

- Emergency fund. Teach the idea of 3–6 months of essential expenses for adults. For teens, start with a beginner emergency fund for small shocks (phone repairs, medical co-pays).

Skills to teach at every age (the glue that holds it together)

These daily skills will pay off more than one-off talks.

- Delayed gratification. Save-and-wait beats instant gratification repeatedly. Use small, achievable goals early on to teach this.

- Numeracy. If your child struggles with percentages, tip math, or fractions, work with them. The OECD links financial literacy with basic maths competence — they’re connected. Financial Times

- Healthy money talk. Normalize conversations about money. Avoid secrecy or shame. Share age-appropriate family financial decisions (not every blip) so kids understand tradeoffs.

- Mistakes as lessons. If they overspend, avoid heavy punishment. Instead, review the situation: what happened, and how could they do it differently next time?

- Charitable giving. Teach empathy by encouraging small giving. It builds social responsibility and helps them see money as a tool for good.

What the research and experts say (short summary)

- Start early. Programs like Money as You Grow recommend age-appropriate activities beginning in early childhood and continuing through adolescence. Engaging children at young ages helps build basic money skills. Consumer Financial Protection Bureau

- Chores are valuable. Longitudinal studies link doing household chores to greater self-competence later in life — chores help more than just the household; they help character. PubMed

- Schools help, but home matters most. National and international frameworks (OECD, NEFE) recommend combined efforts from schools and parents to improve financial competence. Real-life practice at home — allowances, bank accounts, small businesses — reinforces classroom lessons. OECD+1

Tools, apps, and books — kid-tested picks

Here are resource categories and trusted names to explore. I’ll keep it general so you can choose what fits your family.

- Government-backed resources: Money as You Grow (CFPB) has activities and reading guides for ages 3–18 — perfect for parents who want stepwise guidance. Consumer Financial Protection Bureau

- Nonprofit curricula: Jump$tart Coalition and NEFE (National Endowment for Financial Education) provide teacher and parent resources and evaluation toolkits. Great if you want lesson plans or classroom-style activities. Jump$tart Coalition+1

- Books for kids: There are many picture books and middle-grade books about money; CFPB’s Bookshelf curates reading ideas for ages 4–10. Consumer Financial Protection Bureau

- Apps and accounts for teens: Many banks now offer teen-friendly accounts with parental controls. Look for no-fee options and clear parental oversight features. (Check your local banks for youth accounts.)

- Fun project ideas: Entrepreneurship kits, board games (like Monopoly for older kids — but with a twist: track real consequences), and small-business starter guides.

Common questions parents ask (and straightforward answers)

Q: When should I start giving an allowance?

A: Any time after age 5–6 is a popular time to introduce a predictable allowance. The key is consistency and a simple system (spend/save/give jars). Do what fits your family values — whether you tie allowance to chores or not. happilyfamily.com

Q: Should we pay for chores?

A: There’s no one-size-fits-all answer. If chores are paid, kids learn a transactional lesson. If chores are unpaid, kids learn family responsibility. You can combine both: a base allowance plus occasional paid tasks for extras. Research suggests chores have developmental benefits regardless. PubMed

Q: When should they get a credit card?

A: Not in a hurry. If you want to help them build credit, consider a secured card, a small student card with strong limits, or adding them as an authorized user on your card — but only if you trust they’ll be responsible. Teach the dangers of minimum payments and high-interest balances first. Consumer Advice

Q: What if my family can’t afford to give allowance?

A: You don’t need to give money to teach money. Use chores, mock budgets, and role-play stores. Teach them to value planning and decision-making — those lessons don’t cost money.

A realistic, one-year plan you can follow (simple and flexible)

Use this as a blueprint; tweak to your family’s rhythm.

Months 1–3 (Foundation):

- Ages 3–8: Start store play and small counting games. Introduce a piggy bank or jars. Read one money book every two weeks.

- Ages 9–12: Start three-column budgets and track purchases for one month. Introduce savings goals.

- Ages 13+: Open a youth savings account (if not already). Show how deposits and app views work.

Months 4–6 (Build habits):

- Introduce predictable allowance (if you plan to). Start chores as regular family contributions.

- Set a mid-term goal (e.g., save for a gadget) and track progress visually.

- Teach online safety with passwords and basic transaction review.

Months 7–9 (Deeper lessons):

- Introduce small entrepreneurship projects (lemonade, tutoring). Let kids price, cost, and bank proceeds.

- Talk about credit basics with older teens (16+). Compare hypothetical scenarios: save and buy vs. financing and paying interest.

Months 10–12 (Prep for independence):

- Older teens: draft a mock monthly budget for rent and transport; explore student loans vs scholarships.

- Celebrate successes. Revisit failures with a problem-solving mindset.

Quick scripts: what to say and how to say it

Sometimes the hardest part is finding the words. Here are quick, casual lines you can use.

For a toddler:

- “This is a quarter. Four of these make one dollar. Want to buy the sticker?”

For a 7-year-old struggling to save:

- “Saving is like planting seeds. You won’t see the tree tomorrow, but if you water it, something grows.”

For a teen asking for a credit card:

- “Credit is a tool. Use it well, and it can help you. Use it without thinking, and it costs you a lot. Want to test it with a small, managed setup first?”

For when they mess up:

- “Okay, a mistake. We all make them. What did we learn? How would you do it differently next time?”

Tone matters: lean curious, not punitive. Ask questions. Make them think.

Checklist: Age-by-age quick actions

A compact cheat-sheet you can print and stick on the fridge.

Ages 3–5

- Play store with real coins.

- Read money-themed books during storytime.

- Introduce simple “choice” language: buy now vs. save later.

Ages 6–8

- Introduce allowance (optional) and jars/envelopes: Spend/Save/Give.

- Assign chores and discuss fairness and family responsibility.

- Set a small savings goal.

Ages 9–12

- Create a simple budget for allowance or gifts.

- Track one month of spending in a notebook or app.

- Start discussing advertising and peer pressure.

Ages 13–15

- Open youth savings account or add them to family account view.

- Teach online banking safety and password hygiene.

- Encourage earning via part-time gigs and saving a portion.

Ages 16–18

- Explain credit, debt, and interest. Review credit scores basics.

- Practice filing a simple tax return if they earn.

- Build a realistic budget for independent living.

Mistakes parents make (and how to avoid them)

- Overcomplicating early lessons. Keep it playful and small for young kids.

- Talking only about scarcity or shame. Money is neutral. Avoid framing it as “bad” or “scary.”

- Treating allowance and chores inconsistently. Consistency helps. Decide on a system and stick with it for a season.

- Avoiding the topic entirely. Silence teaches its own lessons — often unhelpful ones. Start the conversation.

Final thoughts — long game, not a sprint

Teaching money to kids isn’t about producing investment geniuses by age ten. It’s about giving them tools: the language to talk about money, the habits to manage it, the skills to plan, and the confidence to make choices. Those are life skills — and they compound.

If you do one thing from this guide, make it this: start small and be consistent. A five-minute money chat every week, a predictable allowance, a real bank visit — these tiny, repeated actions will set your child up for decades of better choices.

Resources & further reading (useful, trustworthy sources)

- Money as You Grow — Consumer Financial Protection Bureau (CFPB): age-appropriate activities and a curated “Bookshelf”. Consumer Financial Protection Bureau+1

- Jump$tart Coalition — Resources for financial education and teacher training. Jump$tart Coalition

- NEFE (National Endowment for Financial Education) — Practical evaluation tools and lessons for children. toolkit.nefe.org

- OECD Financial Competence Framework for Children and Youth — International framework and competency guide. OECD+1

- FTC — Understanding Your Credit — Simple, authoritative guide to credit scores and reports. Consumer Advice

- Research on chores and child development — PubMed summary linking chores to later competence (longitudinal study). PubMed

- Investopedia — How to talk to kids about money — Practical parent-facing advice and studies on early habits. Investopedia

- Parents.com — Money habits by age — Practical tips and actionable activities.