Budgeting. Yeah, it’s not the most glamorous word out there — it’s not “travel,” “adventure,” or “freedom.”

But here’s the secret: it’s the quiet little key that unlocks all three.

Whether you’re trying to get out of debt, save for something big, or just stop wondering “where the heck did my paycheck go?” — budgeting is where it all starts.

This isn’t a stiff, accountant-style lecture. Think of it as a friendly, real-world chat about money — what it really means to budget, how to actually do it without hating your life, and the simple mistakes that quietly wreck most people’s plans.

Grab a coffee (or your favorite drink), and let’s talk about how to make a budget that actually works.

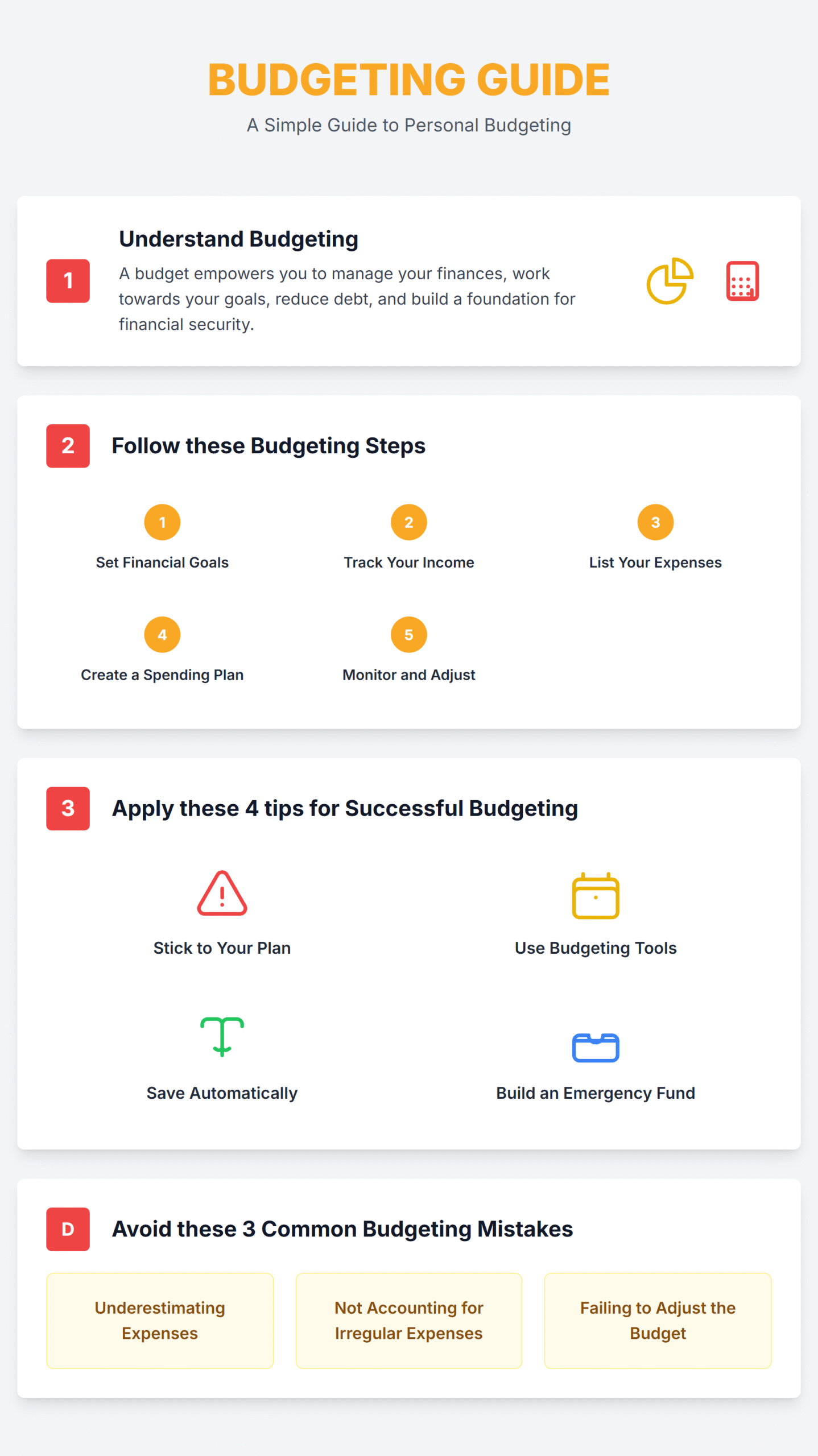

1. Understand Budgeting: What It Really Means

Budgeting isn’t about restricting yourself.

It’s about deciding in advance what matters to you — and making your money behave accordingly.

When you budget, you’re not saying “I can’t spend.” You’re saying “I choose where my money goes.” That’s power.

And that’s the first big mental shift.

Let’s break it down.

Why Budgeting Matters

- You gain control.

You stop being the person who says, “I don’t know where my money goes.”

Instead, you become the one who tells it exactly where to go. - You save for your goals.

Want to travel? Buy a house? Build an emergency fund?

None of that happens by accident — it happens through consistent, planned saving. - You avoid debt traps.

With a budget, you can anticipate bills and avoid surprise shortfalls that push people into credit card debt.

The Federal Reserve and Consumer Financial Protection Bureau both point out that budgeting helps people lower stress and improve financial resilience. - You build financial freedom.

Freedom isn’t about being rich — it’s about not being anxious every time you check your bank app.

So, yeah — budgeting isn’t punishment. It’s self-respect in numbers.

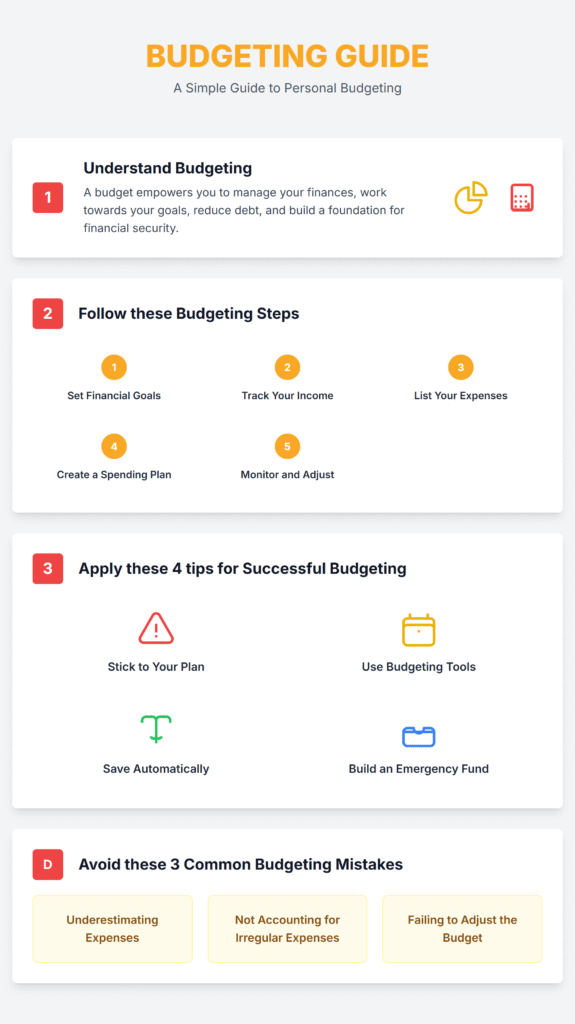

2. Follow These 5 Budgeting Steps

Budgeting doesn’t have to be complicated.

In fact, the simpler it is, the more likely you’ll stick to it.

Let’s walk through the five steps that make any budget work.

Step 1: Set Financial Goals

Before you touch a spreadsheet or an app, figure out what you’re budgeting for.

Ask yourself:

- What do I want to achieve in the next 6 months? 1 year? 5 years?

- Am I saving for security, freedom, or something fun?

Write down your goals. Be specific.

Instead of “save money,” say “save $5,000 for an emergency fund by next June.”

Goals give your budget direction. Without them, your money just drifts.

Pro Tip:

Use the SMART method — goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Example:

- ❌ “I’ll try to save more.”

- ✅ “I’ll save $250 every month for my emergency fund.”

Step 2: Track Your Income

Next, figure out exactly how much money you bring in.

That includes:

- Your salary (after taxes)

- Freelance or side hustle income

- Bonuses, tips, or commissions

- Any government or family support

If your income fluctuates (like for freelancers or gig workers), take the average of the last 3–6 months.

Knowing your real take-home income sets the boundaries of your budget. You can’t plan what you don’t measure.

Step 3: List Your Expenses

Now comes the eye-opening part — where your money actually goes.

List every expense, big or small:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Transportation (fuel, public transport, insurance)

- Groceries

- Subscriptions (Netflix, Spotify, apps)

- Dining out, entertainment

- Savings and investments

To make this easier, check your bank and credit card statements from the past month or two. You’ll be surprised by the “invisible” stuff — those $3 coffees, monthly app renewals, and random online purchases that quietly add up.

Categorize your expenses:

- Fixed expenses: rent, insurance — the non-negotiables.

- Variable expenses: groceries, dining, shopping — flexible areas you can adjust.

Step 4: Create a Spending Plan

Now that you know your income and expenses, it’s time to assign your money to categories.

Here are some popular budgeting methods you can use:

A. The 50/30/20 Rule

- 50% for Needs (housing, bills, groceries)

- 30% for Wants (dining out, shopping, entertainment)

- 20% for Savings or Debt Repayment

It’s simple and works well for beginners.

B. The Zero-Based Budget

Every dollar gets a job.

Income – Expenses = 0.

That doesn’t mean you spend everything — it means you plan for every single dollar, including savings.

C. The Pay Yourself First Method

Before spending on anything else, transfer a chunk into savings right after payday.

If you never see that money in your checking account, you’ll never be tempted to spend it.

Pro Tip:

Start with broad categories. Overcomplicating things makes budgeting feel like homework.

Example:

Housing: $1200

Transportation: $300

Food: $400

Fun: $200

Savings: $300

Total: $2400

See? Clear, realistic, doable.

Step 5: Monitor and Adjust

This is where most people fail — they create a budget, but never check it.

Life changes. Prices rise. Emergencies happen.

Your budget should bend, not break.

Every month, review:

- Did you overspend anywhere?

- Did you save as much as you planned?

- What expenses surprised you?

Adjust categories. Rebalance if needed.

Budgeting is like driving — you need to keep your hands on the wheel, not set it on autopilot.

3. Four Tips for Successful Budgeting

Now that you’ve built a budget, here’s how to make it stick.

Tip 1: Stick to Your Plan

Sounds obvious, right?

But consistency is the hardest part.

Budgeting isn’t about perfection — it’s about awareness and adjustment. You’ll slip sometimes. That’s okay. The key is to review and get back on track quickly.

If you overspend in one category (say, entertainment), cut back a bit elsewhere next month. No guilt — just correction.

Tip 2: Use Budgeting Tools

We live in the golden age of budgeting apps. Use them.

Here are a few popular ones that make your life easier:

- Mint – great for tracking everything automatically.

- You Need a Budget (YNAB) – for zero-based budgeting fans.

- Goodbudget – simple envelope-style budgeting.

- EveryDollar – clean and straightforward, created by financial educator Dave Ramsey.

If you prefer old-school methods, a simple spreadsheet or notebook works just fine. The best tool is the one you’ll actually use.

Tip 3: Save Automatically

This one’s a game-changer.

Set up automatic transfers from your checking account to your savings right after you get paid.

This turns saving into a default behavior — not a chore.

Experts at NerdWallet and CNBC Finance emphasize that automation is one of the top predictors of long-term saving success. It removes willpower from the equation and keeps you consistent.

Start small — even $50 or $100 per month builds momentum. The point is to make saving effortless.

Tip 4: Build an Emergency Fund

If there’s one thing that separates financially stable people from the rest, it’s this:

an emergency fund.

This is your safety net for life’s “uh-oh” moments — job loss, medical bills, car breakdowns, or sudden repairs.

Aim for 3 to 6 months of living expenses.

If that sounds overwhelming, start smaller — try saving $500 first, then build from there.

Why it matters:

Without an emergency fund, people often turn to credit cards or loans in a crisis, which leads to spiraling debt. A 2023 Bankrate survey found that only 43% of Americans could cover a $1,000 emergency from savings — meaning more than half would have to borrow or go into debt.

You can be on the right side of that statistic by starting today.

4. Avoid These 3 Common Budgeting Mistakes

Even with the best intentions, a few simple missteps can sabotage your budget. Here’s what to watch for:

Mistake 1: Underestimating Expenses

We all do this — especially for small, sneaky costs.

Those coffee runs, streaming subscriptions, and delivery fees add up faster than you think.

Fix:

Review the last 3 months of your spending. You’ll spot patterns immediately.

Then, build in a small “miscellaneous” category for those unpredictable extras.

Mistake 2: Ignoring Irregular Expenses

Birthdays, annual car insurance, Christmas gifts — these aren’t monthly, but they’re predictable.

Ignoring them makes your budget look great on paper — until those months hit and everything falls apart.

Fix:

Create a “sinking fund” for irregular expenses.

Set aside a little each month so you’re ready when they roll around.

Example:

If you spend $600 on Christmas every year, save $50 per month starting in January. Easy and stress-free.

Mistake 3: Failing to Adjust Your Budget

Your budget is not carved in stone.

Maybe your income changes. Maybe groceries get pricier. Maybe your priorities shift.

Failing to adjust makes your budget unrealistic — and unrealistic budgets die fast.

Fix:

Review every 30–60 days. Tweak numbers. Update goals.

Your budget should evolve with your life, not fight against it.

Bonus: Real-Life Example — The Budget of “Alex”

Let’s make this real.

Say Alex earns $3,500 a month after taxes. They want to pay bills, enjoy life, and save.

Here’s Alex’s basic 50/30/20 budget:

| Category | % | Amount | Notes |

|---|---|---|---|

| Needs | 50% | $1,750 | Rent, utilities, groceries, insurance |

| Wants | 30% | $1,050 | Eating out, gym, streaming, hobbies |

| Savings/Debt | 20% | $700 | Emergency fund + student loan |

After 3 months, Alex notices they’re overspending on takeout by $150.

No panic — they simply adjust: reduce takeout, increase savings by $100, and add a $50 “miscellaneous” buffer.

That’s what good budgeting looks like: flexible, calm, and controlled.

5. Staying Motivated — Turning Budgeting Into a Habit

Let’s be honest — budgeting isn’t “fun.”

But it can become rewarding once you start seeing progress.

Here’s how to keep the fire alive:

- Celebrate small wins. Saved $200 this month? Treat yourself (responsibly).

- Visualize goals. Use progress bars or charts. Seeing your savings grow is motivating.

- Find accountability. Budget with a partner, friend, or online community.

- Review regularly. Sunday evening check-ins with your budget app can become a relaxing ritual.

The point is not to be perfect. It’s to be consistent.

6. The Long Game — From Budgeting to Financial Freedom

Here’s the magic of budgeting:

Once you master it, everything else becomes easier — saving, investing, even retiring early.

Budgeting gives you:

- Confidence to make decisions.

- Cushion for emergencies.

- Clarity on your priorities.

In other words — peace of mind.

Money stops being chaos and becomes a system that works for you.

Final Thoughts: Budgeting Is Self-Care

Budgeting isn’t just math — it’s emotional.

It’s about creating a life where your money aligns with your values.

You don’t need to be rich to budget.

You budget to get rich — in peace, options, and control.

Start where you are.

Track what you earn.

Decide what matters.

Adjust as you go.

That’s it — simple, real, doable.

And if you stick with it, a few months from now, you’ll look back and think:

“Why didn’t I start this sooner?”

Helpful Resources & References

- Consumer Financial Protection Bureau (CFPB):

Budgeting tools and step-by-step worksheets for individuals and families. - Bankrate Emergency Savings Survey 2023:

Data on Americans’ preparedness for unexpected expenses. - Federal Reserve Financial Well-Being Report:

Research on how budgeting improves overall financial security. - CNBC / NerdWallet Guides on Saving Automation:

Real-world tips for automating savings and managing cash flow. - Dave Ramsey’s “EveryDollar” App:

A free, user-friendly tool for zero-based budgeting. - Mint, YNAB, and Goodbudget:

Popular digital tools for tracking expenses and setting goals. - Financial Wellness Studies — OECD, NEFE:

Data confirming budgeting and goal-setting improve long-term financial habits.