Let’s be real — everyone wants to build wealth, but very few people are ever taught how to do it.

We’re told to “save more” or “invest early” — but without understanding the bigger picture, most people end up hustling endlessly, paying bills, and wondering why they’re still stuck on the same financial treadmill.

Here’s the truth: wealth isn’t just about having a fat paycheck or buying fancy stuff.

It’s about building a system that supports your freedom — freedom to make choices, spend time how you want, and give your family a better future.

And to do that, you need to master what I like to call The Five Pillars of Wealth.

Each one builds on the other. If one is weak, the whole structure wobbles.

But if you strengthen all five? You set yourself up for a lifetime of stability, growth, and peace of mind.

Let’s walk through them one by one.

Pillar 1: Income – The Engine That Powers Everything

You can’t build wealth without money coming in. That’s obvious — but what’s not obvious is how you grow that income over time.

💬 So the first question is: How do I earn more?

It’s not about working harder. It’s about working smarter.

If you want to earn more, you have to be more valuable — and that means improving your skills.

Think about it this way:

If your income right now is tied to your job, then your job pays you based on how valuable your skills are in the marketplace.

Want to earn more? Make your skills rarer and more useful.

For example:

- A barista can earn more by learning management and becoming a café manager.

- A designer can double their rate by mastering UX or AI tools that clients desperately need.

- A civil engineer can move into project management or start consulting independently.

The formula is simple:

More skill = more value = more income potential.

🧠 Ask yourself:

“What skills do I need to be valuable enough to earn more?”

That’s the million-dollar question. Literally.

Invest in learning — not just formal education, but real-world skills.

Learn negotiation, communication, sales, leadership, digital tools, and financial literacy.

Read books, take online courses, shadow people you admire, and constantly level up.

As billionaire Warren Buffett once said:

“The best investment you can make is in yourself.”

Because unlike stocks or property, nobody can take your skills away.

Pillar 2: Taxes – The Silent Wealth Killer

Taxes are necessary — they build our roads, schools, and systems. But let’s be honest: if you don’t understand how taxes work, they’ll quietly eat away at your wealth faster than you can earn it.

💬 So the question becomes: How do I pay less (legally)?

No, this doesn’t mean “evade” taxes — it means understand them.

The tax code isn’t just a set of rules for taking your money — it’s a guidebook for what the government encourages people to do.

You pay less when you do the things that build the economy — like investing, creating jobs, or owning assets.

For example:

- In many countries, investment income is taxed lower than salary income.

- Business expenses can be deducted — meaning if you run a side business, your laptop, internet, and even a part of your rent might be deductible.

- Retirement accounts and health savings accounts (HSAs) can lower your taxable income.

🧾 The smart move? Learn the rules of the game.

Ask yourself:

“What laws do I have to read up on?”

You don’t need to become a tax expert overnight — but you do need to get curious.

Talk to a financial advisor, watch tax tutorials on YouTube, read your country’s tax guide, and look for legal tax advantages that apply to you.

Think of it like this:

If you earn $100,000 and pay $30,000 in taxes, you’ve lost 30% of your effort before you even start investing.

But if you structure things wisely, you might legally pay $20,000 instead — and that $10,000 difference could be the seed of your next investment.

As the saying goes:

“It’s not what you earn. It’s what you keep.”

Pillar 3: Savings – The System That Protects You

Let’s be real: saving isn’t sexy.

Nobody brags about their emergency fund on Instagram.

But saving is what separates the financially stable from the constantly stressed.

💬 The key question: How do I spend less?

You can’t just hope to save money. You need systems that make it happen automatically.

That’s because humans aren’t great at self-control — especially when it comes to money. If you wait until the end of the month to “see what’s left,” spoiler alert: there won’t be much left.

So instead of relying on willpower, set up systems that force you to save.

Here’s how:

- Automate transfers to your savings account right after you get paid. Treat it like a bill.

- Create separate accounts for goals — one for emergencies, one for travel, one for investments.

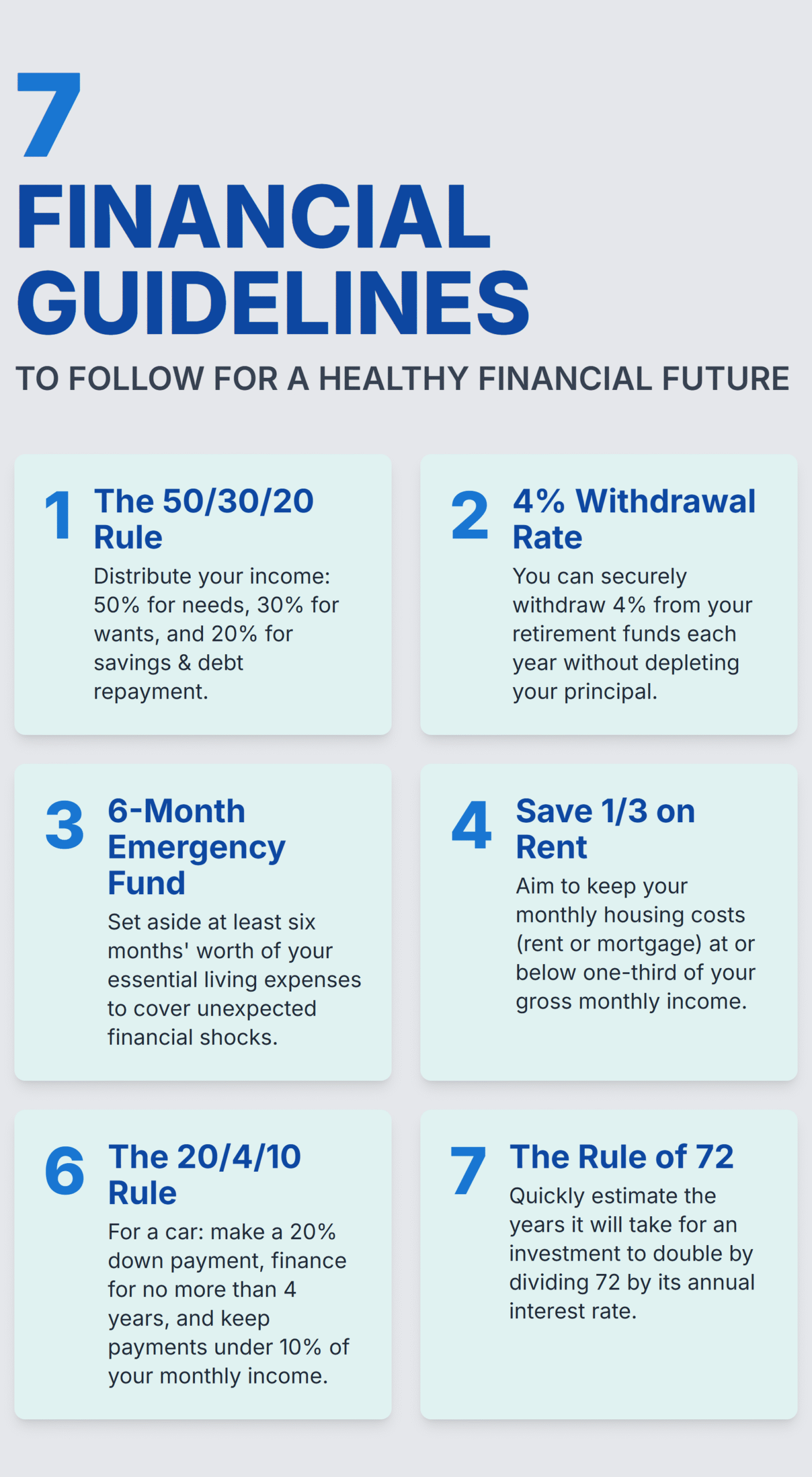

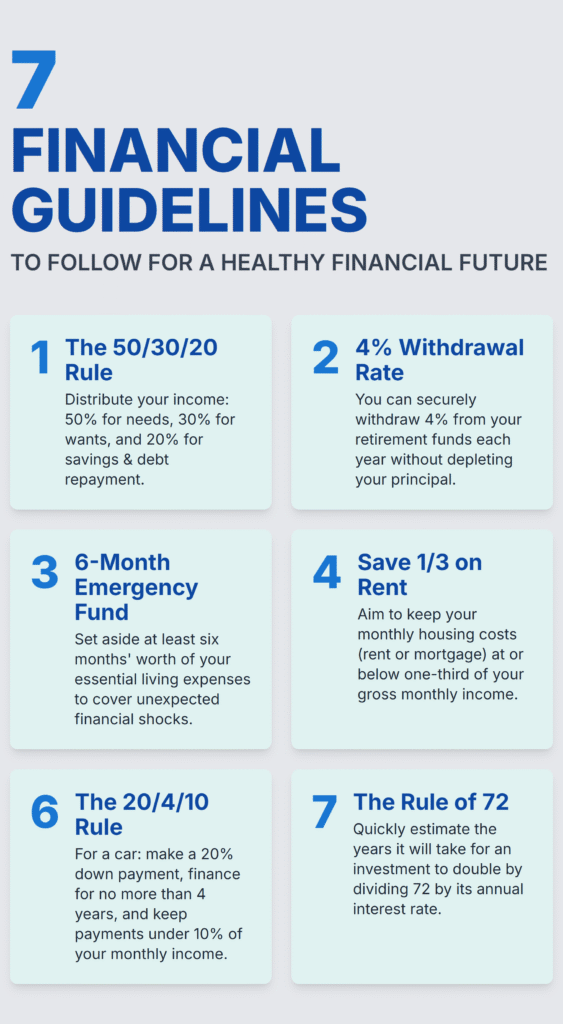

- Use the 50/30/20 rule — 50% for needs, 30% for wants, 20% for savings/investments.

- Cut subscriptions ruthlessly. You’ll be surprised how many “free trials” turned into mini financial leaks.

Saving money isn’t about being cheap.

It’s about giving yourself options.

It’s the foundation that lets you survive bad months, take risks, or invest without panic.

As author Ramit Sethi says in I Will Teach You to Be Rich:

“Spend extravagantly on the things you love, and cut mercilessly on the things you don’t.”

The point isn’t to deprive yourself. It’s to direct your money where it truly matters.

Pillar 4: Investing – Making Your Money Work For You

Once you’ve got your income flowing and your savings stable, the next step is where the magic really happens: investing.

💬 The core question: How can I find the best risk-to-reward investment?

Every investment carries risk. There’s no magic bullet.

But your goal is to find opportunities that match your goals, your time horizon, and your comfort level.

If you’re young, you can take more risk — because you’ve got time to recover.

If you’re older, your priority shifts to protection and income.

🧠 The smarter question is:

“How can I analyze any investment to determine its likely risks and returns?”

Here’s a basic process that even non-experts can use:

- Understand the Asset:

What are you investing in — a company, property, index fund, or something else?

Don’t invest in what you don’t understand. - Evaluate Risk vs. Reward:

What’s the potential upside? What could go wrong?

If it sounds too good to be true — it probably is. - Check Liquidity:

How easy is it to get your money back? Stocks are liquid. Real estate isn’t. - Diversify:

Never put all your eggs in one basket. Spread across different assets — stocks, bonds, property, and maybe a business. - Stay Consistent:

Wealth is built over time, not overnight. The market rewards patience.

As legendary investor Charlie Munger said:

“The big money is not in the buying or selling, but in the waiting.”

So whether you’re investing in ETFs, real estate, or even your own business — be patient, consistent, and informed.

Pillar 5: Legacy – Building Wealth That Outlives You

The last pillar is the one most people forget: legacy.

Because wealth isn’t just about you. It’s about what you leave behind.

You’ve worked hard, saved, and invested — but what happens next?

What values, lessons, and systems are you passing on to your kids?

💬 The real question:

“How can I give my kids a good life without depriving them of the struggle that built me?”

That’s a delicate balance.

You want your children to have opportunities you didn’t — but you also want them to appreciate effort, responsibility, and discipline.

Here’s how you can do both:

- Teach them about money early. Let them manage small amounts, make mistakes, and learn.

- Create family wealth rules. For example, “We always give 10%,” or “We never borrow for wants.”

- Share your story. Let them understand how you built what you have — not to brag, but to show the process.

- Set up systems. Wills, trusts, and education funds ensure your legacy continues smoothly.

Legacy isn’t just about money — it’s about mindset.

It’s about raising the next generation to be better, smarter, and more grateful than the last.

As one wise saying goes:

“Strong men create good times. Good times create weak men. Weak men create hard times. Hard times create strong men.”

The goal is to break that cycle — by teaching your kids wisdom before they have to learn it the hard way.

Bringing It All Together: The 5-Pillar Framework

Let’s recap what we’ve covered:

| Pillar | Core Question | Key Action |

|---|---|---|

| Income | How do I earn more? | Learn skills that make you valuable |

| Taxes | How do I pay less (legally)? | Understand and apply tax laws smartly |

| Savings | How do I spend less? | Set up automated systems to save |

| Investing | How can I grow wealth? | Find good risk-to-reward opportunities |

| Legacy | What do I leave behind? | Pass on values, knowledge, and structure |

Master these five, and you’re no longer just “managing” money — you’re directing it like a pro.

Wealth stops being something that happens to “lucky” people.

It becomes something you build — step by step, decision by decision.

A Few Practical Tips to Strengthen Each Pillar

💰 Income

- Network with people earning what you want to earn. Learn what they know.

- Take on projects that stretch you — that’s where growth happens.

- Negotiate your salary; most people leave 10–20% on the table simply by not asking.

📜 Taxes

- Learn the basics of deductions and credits.

- Keep receipts — small business owners often lose thousands because they don’t track expenses.

- If your country offers tax-free investment accounts, use them.

💵 Savings

- Use an app like YNAB or Mint to track where your money goes.

- Set clear savings goals — “I’m saving $10,000 for my first property” feels more real than “I should save more.”

- Remember: automation beats motivation every time.

📈 Investing

- Don’t chase trends — invest in what you understand.

- Learn the power of compounding. Even $200/month invested early can snowball over decades.

- Stay calm during market dips. The real danger is panic, not volatility.

🏛 Legacy

- Talk openly about money with your family.

- Write a will — even if you’re young. It’s peace of mind.

- Teach generosity. Wealth that flows outward always grows stronger.

Final Thoughts: Wealth Is Built, Not Found

You don’t need to be born rich, win the lottery, or stumble into the next crypto boom.

You just need to understand the five pillars and strengthen them — little by little.

Start with what you have.

Track your progress.

Adjust as you grow.

Because wealth isn’t a single finish line — it’s a lifelong journey toward freedom, confidence, and purpose.

And the best part?

Once you master it, you’ll be able to help others — your kids, your community, even strangers — learn how to do the same.

That’s real wealth.

Sources and Further Reading

- Ramit Sethi – I Will Teach You to Be Rich

- Morgan Housel – The Psychology of Money

- Robert Kiyosaki – Rich Dad Poor Dad

- Thomas J. Stanley – The Millionaire Next Door

- Warren Buffett’s Letters to Shareholders

- Charles Duhigg – The Power of Habit

- Investopedia (www.investopedia.com)

- Dave Ramsey – The Total Money Makeover

- U.S. IRS Tax Tips – www.irs.gov

- Forbes Money and Personal Finance Section