Financial freedom isn’t just about being “rich.”

It’s about reaching a point where money stops controlling your life, your stress reduces, and your future feels secure. But the truth is, financial freedom doesn’t happen overnight—it happens in levels.

Just like in a video game, you don’t jump straight to the final stage. You unlock it step by step.

This article explains the 7 Levels of Financial Freedom, what each level means, and how you can move forward no matter where you are right now.

Let’s break it down in a simple and practical way.

What Are the 7 Levels of Financial Freedom?

The 7 levels are basically a roadmap that shows your journey from struggling financially to having complete wealth and security.

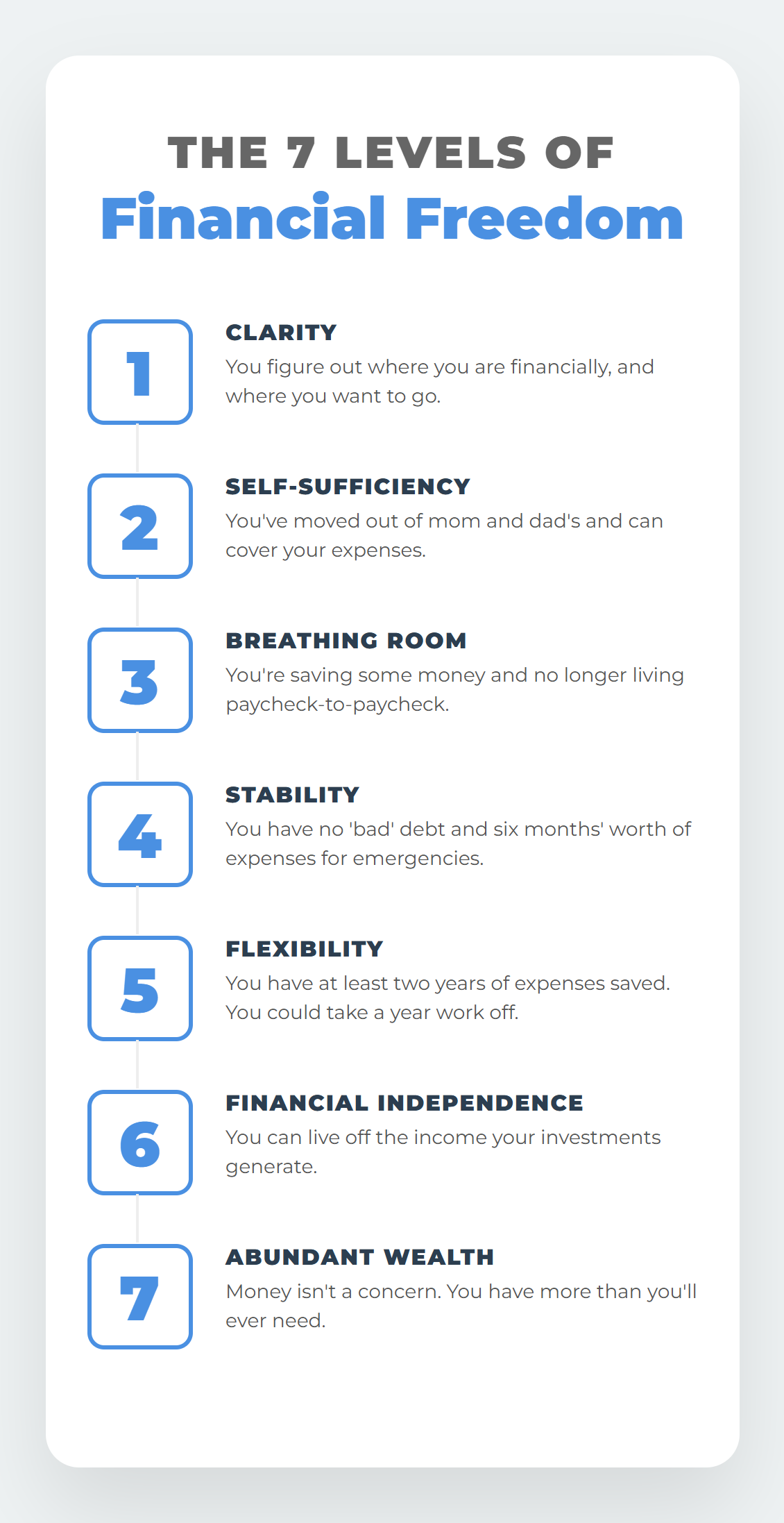

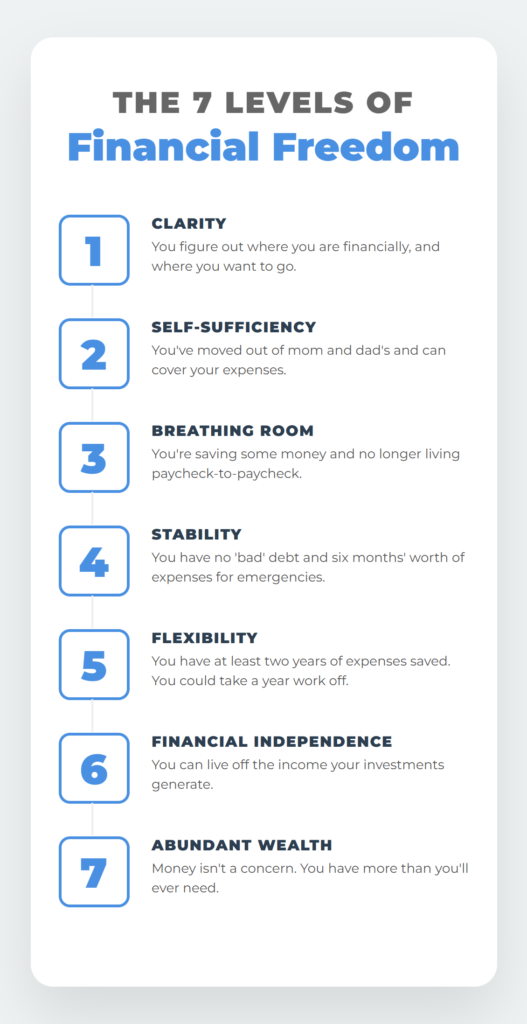

The levels are:

- Clarity

- Self-Sufficiency

- Breathing Room

- Stability

- Flexibility

- Financial Independence

- Abundant Wealth

Each level represents a stronger financial position and a better quality of life.

Level 1: Clarity

What it Means

This is the starting point.

At this stage, you finally stop avoiding your finances and begin understanding:

- How much money you earn

- How much you spend

- How much debt you have

- What your financial goals are

You may still be struggling, but at least you’re aware.

Signs You’re in Level 1

✅ You check your bank account regularly

✅ You know your monthly income

✅ You are starting to track expenses

❌ You may still be living paycheck-to-paycheck

❌ You may have credit card or loan debt

Why Level 1 is Powerful

Most people never even reach this stage.

They live blindly, spending money without planning, and wonder why they’re always broke.

Clarity is the foundation of wealth.

How to Move to Level 2

- Track every expense for 30 days

- Create a basic budget

- Identify unnecessary spending

- Start learning personal finance

Even if your income is low, clarity gives you control.

Level 2: Self-Sufficiency

What it Means

At this stage, you are fully responsible for your life financially.

You are no longer relying on parents, friends, or someone else to pay your bills.

You can cover:

- Rent

- Food

- Utilities

- Transportation

This is the stage where adulthood becomes real.

Signs You’re in Level 2

✅ You pay your own bills

✅ You cover your basic needs

❌ You may still struggle to save

❌ You may still have little to no emergency fund

Why This Level Matters

Self-sufficiency gives you confidence.

Even if you’re not saving much yet, you’ve proven that you can survive on your own.

How to Move to Level 3

- Increase income through side hustles

- Reduce unnecessary expenses

- Start saving even small amounts

- Avoid lifestyle inflation

The goal is not luxury yet.

The goal is breathing space.

Level 3: Breathing Room

What it Means

This is the stage where life feels less stressful.

You’re no longer living in panic mode.

You have enough money to cover your bills, and you’re not constantly worried about the next paycheck.

Signs You’re in Level 3

✅ You can pay your bills without stress

✅ You have a little extra money after expenses

✅ You are not borrowing money regularly

❌ You may not have a strong emergency fund yet

Why It’s Called “Breathing Room”

Because this is the stage where you finally feel like:

“Okay… I can breathe now.”

You’re not rich, but you’re stable enough to stop feeling trapped.

How to Move to Level 4

- Save 10% to 20% of your income

- Pay off high-interest debt

- Start building an emergency fund

- Control impulse spending

This level is where smart habits begin.

Level 4: Stability

What it Means

Now you’re getting serious.

At this level, you have:

- No bad debt (or very low debt)

- At least 6 months of emergency savings

This means if you lose your job tomorrow, you can still survive for half a year without panic.

Signs You’re in Level 4

✅ You have emergency savings

✅ You are not drowning in debt

✅ You can handle unexpected expenses

✅ You feel safe financially

Why Stability is a Game-Changer

This is where life starts to change dramatically.

Because now you are no longer desperate.

And when you’re not desperate, you make better decisions.

You stop accepting toxic jobs, bad deals, and stressful situations.

How to Move to Level 5

- Save aggressively (20%–40% if possible)

- Start investing

- Build multiple income streams

- Improve skills to increase salary

At this stage, you go from survival to freedom planning.

Level 5: Flexibility

What it Means

Flexibility means you have enough savings to take time off without your life collapsing.

According to the infographic, you have:

✅ At least 2 years of expenses saved

✅ You could take a year off work if needed

This is where you begin to feel powerful.

Signs You’re in Level 5

✅ You can quit your job if you want

✅ You can take a break and still survive

✅ You can change careers safely

✅ You have real savings and investments

Why This Level Feels Amazing

This is the stage where you stop feeling trapped.

You’re not stuck in your job.

You’re not stuck in your city.

You’re not stuck in stress.

You finally have options.

How to Move to Level 6

- Invest consistently (stocks, index funds, real estate)

- Build passive income sources

- Create digital products or business assets

- Focus on long-term wealth building

At Level 5, your savings protect you.

At Level 6, your investments start paying you.

Level 6: Financial Independence

What it Means

This is where the real dream becomes reality.

At this level, you can live off income generated by your investments.

That means you don’t need a job to survive.

Your money works for you.

Signs You’re in Level 6

✅ Your investments cover your living expenses

✅ You can retire early if you want

✅ You work because you want to, not because you have to

✅ Your stress level is extremely low

Sources of Financial Independence Income

- Dividend stocks

- Rental properties

- Business profits

- YouTube income

- Affiliate marketing

- Royalties from books

- Digital product sales

Why This Level is Rare

Because most people never learn how to invest properly.

They spend their entire lives working and never build assets.

Financial independence requires patience, discipline, and long-term thinking.

How to Move to Level 7

- Scale your investments

- Increase your income

- Build businesses

- Create assets that generate income even while you sleep

This is where wealth becomes unstoppable.

Level 7: Abundant Wealth

What it Means

This is the highest stage.

At this level, money is no longer a concern.

You have more than you will ever need.

The infographic describes it perfectly:

“Money is not a concern. You have more than you’ll ever need.”

Signs You’re in Level 7

✅ You don’t worry about bills at all

✅ You can buy what you want without stress

✅ You can support your family easily

✅ You can donate, invest, and help others

✅ Your wealth continues growing automatically

What People Do at This Level

At Level 7, people focus on:

- Legacy building

- Charity and giving back

- Generational wealth

- Buying assets for long-term growth

- Helping communities and family

This is where wealth becomes bigger than lifestyle.

It becomes impact.

The Biggest Mistake People Make in the Financial Freedom Journey

Most people think financial freedom is only one thing:

“Having a lot of money.”

But that’s wrong.

The real goal is:

Freedom + Security + Peace of mind

You can earn a lot and still be broke if your spending is out of control.

And you can earn average income and still become wealthy if you build smart habits.

How to Know What Level You’re On

Here’s a simple breakdown:

If you don’t know your finances → Level 1

If you pay your bills but can’t save → Level 2

If you can save a little and not panic → Level 3

If you have 6 months emergency savings → Level 4

If you have 2 years savings → Level 5

If investments pay your expenses → Level 6

If you have more money than you need forever → Level 7

Wherever you are right now, don’t feel ashamed.

Everyone starts somewhere.

How to Move Up Faster (Practical Strategy)

If you want to go from Level 1 to Level 5+ faster, follow this simple plan:

Step 1: Increase Income

The fastest way to level up is to earn more.

Side hustles that actually work:

- Freelancing

- Blogging

- Affiliate marketing

- YouTube

- Selling digital products

- WordPress web design

Step 2: Control Lifestyle Inflation

The more money you make, the more you’ll want to spend.

That’s the trap.

Rich people don’t just earn more—they keep more.

Step 3: Pay Off Bad Debt

Credit card debt and high-interest loans will destroy your progress.

If you want financial freedom, debt has to go.

Step 4: Build Emergency Savings

Your emergency fund is your shield.

Without it, one crisis can take you back to Level 1.

Step 5: Start Investing Early

Even small investing is powerful if you do it consistently.

Because time is your biggest advantage.

Final Thoughts: Financial Freedom is a Journey, Not a Shortcut

The 7 levels of financial freedom prove one important thing:

You don’t become financially free in one big jump.

You build it step by step.

You learn.

You earn.

You save.

You invest.

You grow.

And slowly, you reach a life where money stops controlling you.

The best part?

You don’t need to be born rich.

You just need the discipline to keep moving upward.

Quick Summary of the 7 Levels of Financial Freedom

- Clarity – You understand your financial situation

- Self-Sufficiency – You can cover your expenses

- Breathing Room – You’re no longer paycheck-to-paycheck

- Stability – No bad debt + 6 months emergency savings

- Flexibility – 2 years savings + freedom to take time off

- Financial Independence – Investments cover your lifestyle

- Abundant Wealth – Money is no longer a concern